An uptick in Bitcoin (BTC) supply to whales’ addresses witnessed across January appears to be stalling midway as the price continues its intraday correction toward $42,000, the latest data from CoinMetrics shows.

Whales, fishes take a break from Bitcoin

The sum of Bitcoin being held in addresses whose balance was at least 1,000 BTC came to be 8.10 million BTC as of Feb. 16, almost 0.12% higher month-to-date. In comparison, the balance was 7.91 million BTC at the beginning of this year, up 2.4% year-to-date.

Notably, the accumulation behavior among Bitcoin’s richest wallets started slowing down after BTC closed above $40,000 in early February. Their supply fluctuated within the 8.09-8.10 million BTC range as Bitcoin did the same between $41,000 and $45,500, signaling that demand from whales has been subsiding inside the said trading area.

A similar outlook appeared in addresses that hold less than 1 BTC, also called “fishes,” showcasing that they had halted the accumulation of Bitcoin in February as its price entered the $41,000-45,500 price range.

Looks like the accumulation trend is stalling with #BTC around $44k:

No breakout for the whales addresses.

Plateau for the small fish.I guess everyone is cautious while waiting to see what the FOMC will do next. pic.twitter.com/Ou8w1t7U5m

— ecoinometrics (@ecoinometrics) February 17, 2022

Ecoinometrics’ analyst Nick blamed the Federal Reserve’s aggressive tightening plans for making Bitcoin whales and fishes “cautious,” reiterating his statements from last week, wherein he warned that “if Bitcoin has greatly benefited from quantitative easing, it can also be hurt by quantitative tightening.”

“This is why inflation not showing any sign of slowing down is a big deal.”

No “dot plot” yet

On Wednesday, the Federal Open Market Committee released the minutes of its January meeting, revealing a group of thoroughly alarmed central bank governors looking more prepared to hike rates too much to contain inflation.

As for how fast and how far the rate hikes would go, the minutes did not leave any hints.

To hike or not to hike? The Fed keeps Bitcoin markets in limbo. https://t.co/O0ty3kHKc8 pic.twitter.com/R4io3NMLia

— Cointelegraph Markets (@CointelegraphMT) February 17, 2022

Vasja Zupan, president of Dubai-based Matrix exchange, told Cointelegraph that the Fed fund futures market now sees a 50% possibility of a 50bps rate hike in March, a drop from the previous 63%. But the minutes themselves do not discuss a 0.5% interest rate increase anywhere.

“Of course, the mixed macroeconomic outlook has left Bitcoin’s most influential investors — the whales and long-term holders — in the dark,” asserted Zupan, adding:

“The top cryptocurrency has been cluelessly tailing day-to-day trends in the U.S. stock market. However, I see it as weighted and not long-term significant, especially as the Fed bosses—hopefully—shed more light on their dot-plot after the March hike.”

Strong hodling sentiment

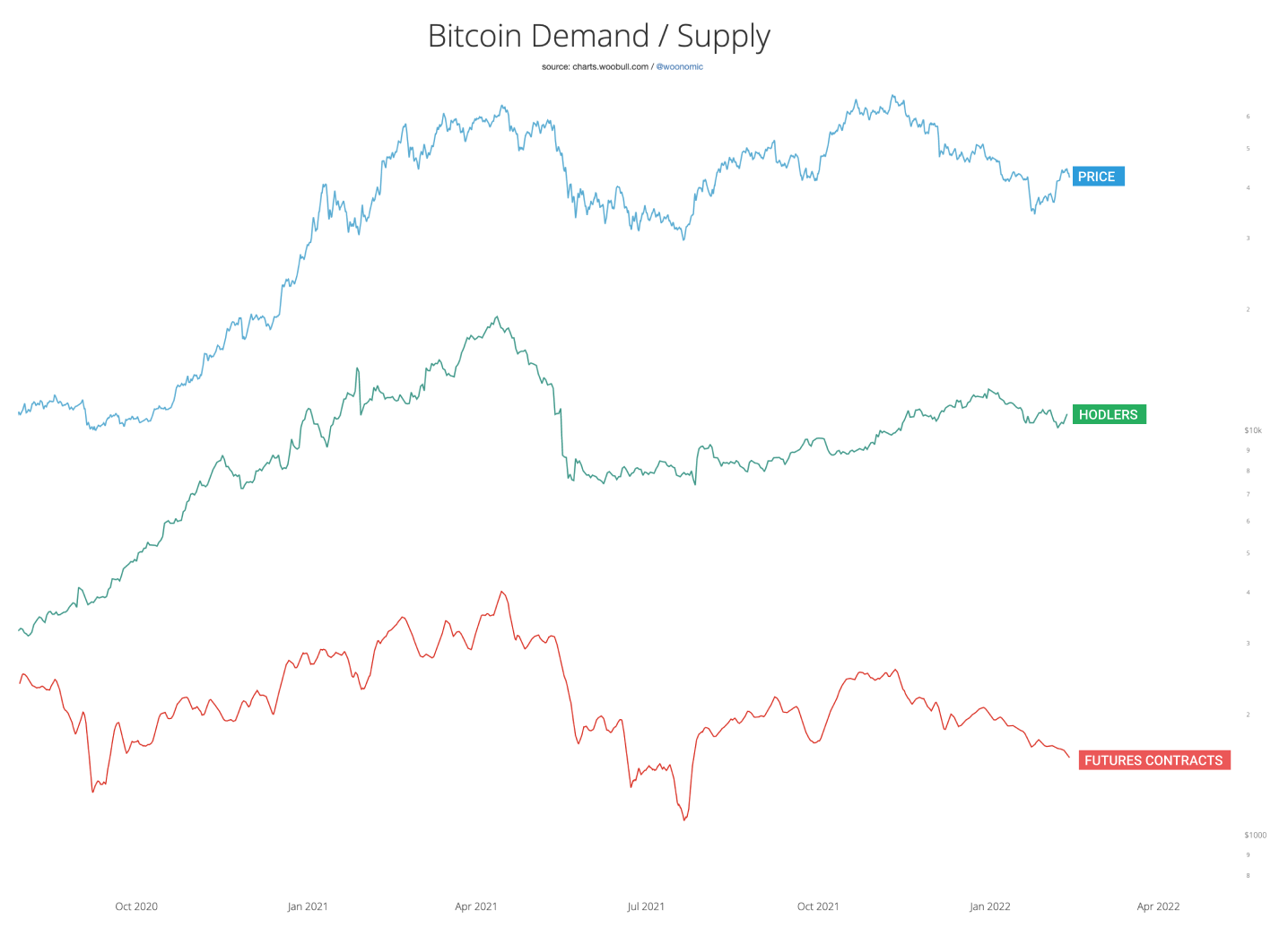

Researcher Willy Woo provided a long-term bullish outlook for Bitcoin, noting that its recent price declines, including the 50% drawdown from $69,000, were due to selling in the futures market, not on-chain investors.

“In the old regime of a bearish phase (see May 2021), investors would simply sell their BTC into cash,” Woo wrote in a note published Feb. 15, adding:

“In the new regime, assuming the investor wants to stay in cash rather than to rotate capital into another asset like equities, it’s much more profitable to hold onto BTC while shorting the futures market.”

Related: Bitcoin briefly dips below $43K as Fed says rate hike ‘soon appropriate’

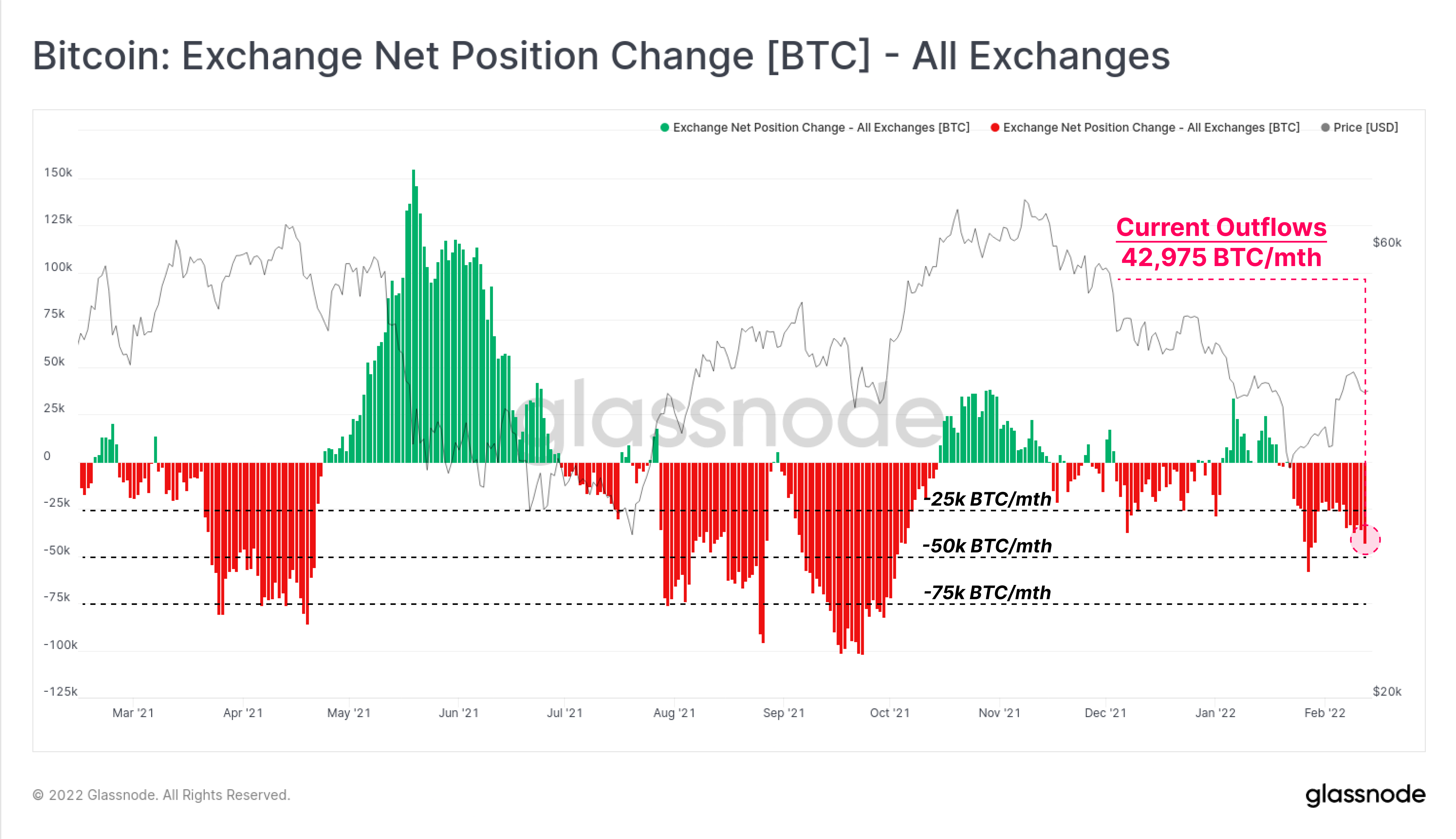

As Glassnode further noted, in the May-July 2021 session, investors’ de-risking in the Bitcoin futures market coincided with a sale of coins in the spot market, which was confirmed by a rise in net coin inflow to exchanges. But that is not the case in the ongoing price decline, as shown in the chart below.

“Across all exchanges we track, BTC is flowing out of reserves and into investor wallets at a rate of 42.9k BTC per month,” Glassnode wrote, adding:

“This trend of net outflows has now been sustained for around 3-weeks, supporting the current price bounce from the recent $33.5k lows.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.